|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

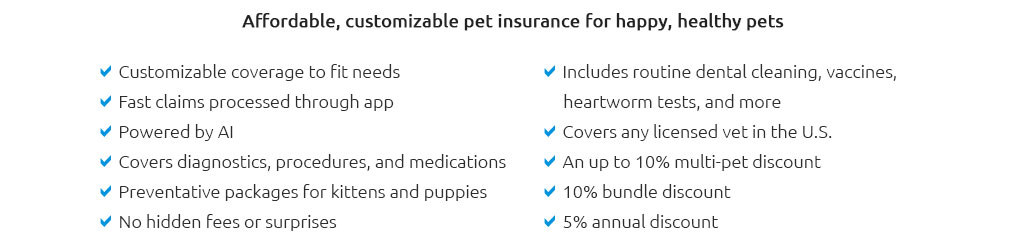

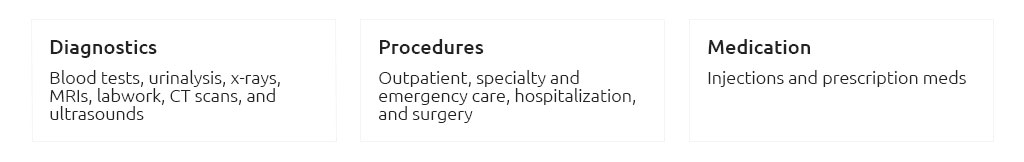

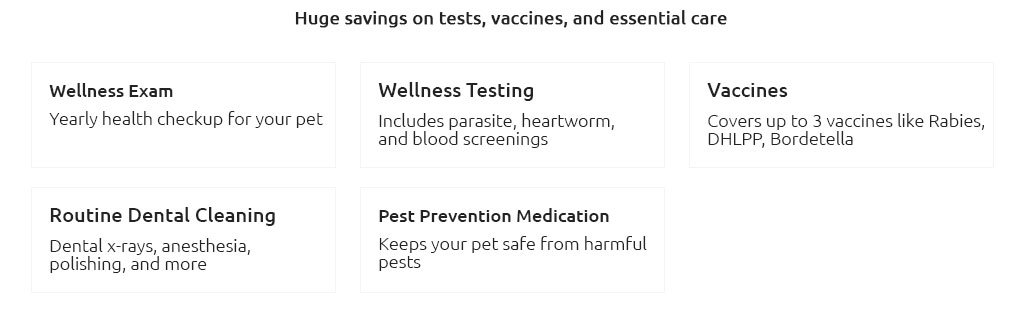

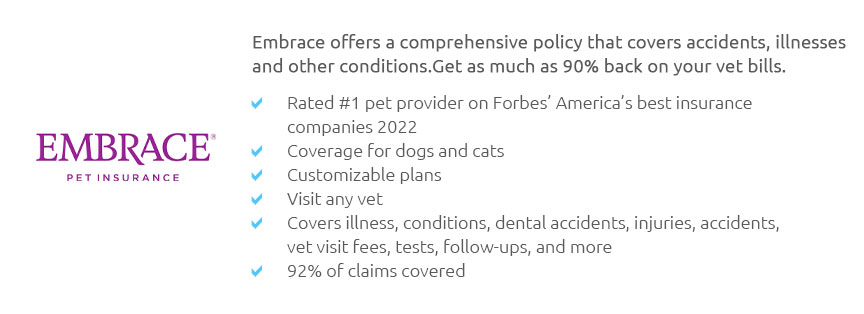

Pet Insurance Comparisons: Navigating the Complex LandscapeIn today's world, the love and care we extend to our pets are often akin to those we provide for family members. As such, ensuring their health and well-being becomes paramount. One of the burgeoning trends in pet care is the rising popularity of pet insurance. With a plethora of options available, making a decision can be overwhelming. This article aims to guide you through the nuanced landscape of pet insurance comparisons, offering insights into the pros and cons of various options. Understanding Pet Insurance Pet insurance, at its core, is a health policy for your pet that reimburses you for certain medical expenses. These can range from accidents and illnesses to routine care and preventive services. The intricacies of each policy can vary significantly, making it crucial to understand what each plan offers. Key Features to Consider

Pros of Pet Insurance

Cons of Pet Insurance

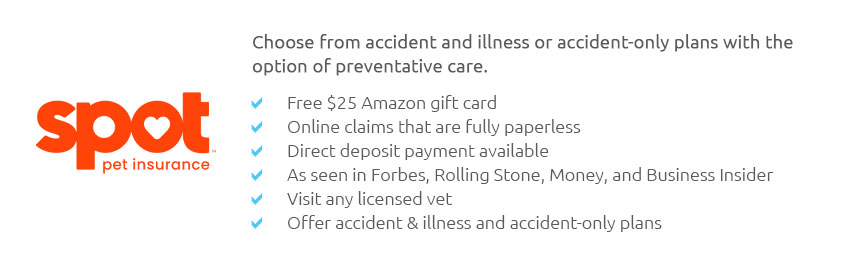

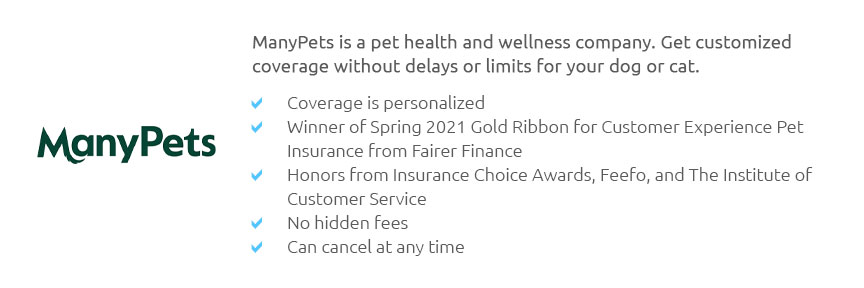

Making an Informed Decision When it comes to selecting the right pet insurance, it’s important to weigh these pros and cons carefully. Assess your financial situation, the specific needs of your pet, and how much risk you are willing to assume. Research is crucial-read reviews, compare multiple plans, and perhaps even consult with your veterinarian for recommendations. Ultimately, the goal is to find a policy that aligns with your needs and offers the best balance of cost and coverage. Conclusion In conclusion, pet insurance can be a worthwhile investment for many pet owners, offering both financial protection and peace of mind. However, it requires thoughtful consideration and diligent research to choose the right plan. By understanding the different aspects of pet insurance, you can make an informed decision that best supports the health and happiness of your beloved furry companion. Remember, the right policy is one that fits both your budget and your pet's needs, ensuring that you can provide the best possible care without undue financial strain. https://www.petinsurance.com/comparison/spot-pet-insurance/

See for yourself why Nationwide is the most popular pet insurer year after year. Compare our coverage and pricing to Spot Pet Insurance pet insurance plans ... https://www.petinsurancereview.com/dog-insurance

The following rankings are based entirely on the experiences of real pet parents just like you. Use our handy comparison chart to find the best dog insurance ... https://www.pawlicy.com/

Pawlicy Advisor provides free quotes, comparison charts, and help from licensed agents to get you the best pet insurance for your breed at the lowest rate.

|